In our recent blog introducing mass timber, we shared why we are excited about mass timber and why it has such great potential to transform the built environment. Today, we would like to talk about where the industry is today: what does the mass timber market look like, what barriers are preventing further growth, and what insights can we draw from these trends?

Mass Timber Market Size & Growth

The past decade has seen explosive growth in mass timber. In 2015, the world was producing 500,000 m3 of mass timber, the vast majority of that in Austria (North America was producing about 100,000 m3). Since then, production has grown exponentially: global production topped 2.8M m3 in 2020, >40% year-on-year growth. North America in 2020 will produce roughly 820,000 m3 of mass timber: 8x the volume produced just 5 years ago, and corresponding to roughly ~$575M in market value.

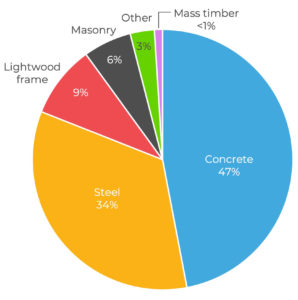

Proponents of mass timber see this trend continuing, as use of the material grows more widespread. There are several factors driving this growth, like a heightened focus in the industry on construction’s carbon impact, new technologies that allow builders to build quickly and efficiently with mass timber, and policy changes that allow for taller structures in mass timber. And while the recent growth in mass timber has been rapid, it still holds a very small share (<1%) of the overall construction materials market. For comparison, mass timber’s $575M North America 2020 market size is dwarfed by the $277.7 billion US 2020 Construction Materials market.

Share of US Construction Market by Material %

In terms of potential market size, mass timber still has huge potential. If we look at Finland as a case example, in 2010 mass timber had less than a 1% market share in mid-rise residential construction. Through a combination of policy changes and industry coordination, that share had grown to 10% in 2015. Building codes were changed in 2011 to allow for multi-storey construction (up to 8) and the government implemented a National Wood Program which supported and coordinated industry development across the country. Major producers like Stora Enso and MetsäWood ramped up production while developers, construction companies, and researchers coordinated efforts to build in mass timber.

If we bring the Finnish case to Canada, we see a huge potential for mass timber. If Ontario reached only half of the mass timber market share that Finland achieved, that corresponds to >1,000 multi-storey residential buildings built in mass timber per year (in 2019, Ontario built 21,400 multiple dwelling residential buildings). Using a conservative 1,500 m2 benchmark as the average size of a multiple dwelling residential building, that corresponds to 620,000 m3 production capacity and a $434M market for mass timber just in Ontario (Reference 1). That also would avoid emitting an estimated 486,000 tonnes of CO2 and sequester an additional 420,000 tonnes of CO2, the equivalent of 130,000 cars driving for a year. This doesn’t include the additional impact of other types of construction that mass timber is also suitable for, such as mid-rise commercial, institutional, governmental, and industrial.

Trends Driving Growth

While we’ve seen the potential for growth, what are the trends actually driving mass timber growth in Canada and globally?

Prioritizing Sustainability

Primarily among them is the move towards sustainability and an increased focus on embodied carbon. Especially as electricity generation and mobility have started to decarbonize more significantly, the focus on building materials emissions has grown (estimated at 11% of global GHG emissions). This report from Architecture 2030 demonstrates the critical role of reducing embodied carbon emissions in achieving global climate goals. Here at Mantle314, we’ve been working to support businesses and governments in analyzing and reducing their embodied carbon (check out our blog on Beyond Energy Efficiency: How a focus on low carbon materials can set your green building apart), and we’ve seen first-hand how the topic has become top-of-mind for political and business leadership. Mass timber’s combination of cost-effectiveness, desirability, safety, and ease of use make it a particularly effective way to address embodied carbon in construction, decarbonize the built environment, and reduce global emissions.

Technological Advances Unlock Mass Timber Efficiency

New technology is an important factor enabling the efficiency of mass timber construction and giving hope to the potential for outperforming concrete and steel on cost. The emergence of building information modeling (BIM) software like Autodesk along with the Design for Manufacture and Assembly (DfMA) technique has enabled design-led production, coordinating building design with material production and the construction process. BIM software allows for architects to build a fully-detailed 3D model of planned buildings. These models can calculate with exacting precision not just how much of every material is needed for construction, but their exact shapes down to the centimeter. This is complemented by CNC (Computer Numerical Control) cutting machinery that automates the cutting process for completed timber panels and beams. Additional software can sequence parts, either to be optimally packed to fit most efficiently in a shipping container or in the exact sequence needed to assemble the building onsite. Employing this DfMA technique can greatly reduce design, manufacturing, and construction cost.

Employing DfMA can greatly reduce design, manufacturing, and construction cost by removing repetitive work and automating several time-consuming steps. For example, instead of needing to cut out holes for windows on-site, or waiting a day per storey for cast concrete to dry, mass timber designs can be machine cut in the factory to the shape required, and just unpacked and assembled on-site, leading to gains in construction speed, assembly cost, quality, energy use, and safety. The simple and straightforward assembly is similar to earlier prefabricated and modular construction techniques, however because of the digitally automated custom cutting process, rather than resulting in numerous copies of identical structures it enables for mass customization of buildings. Mass customization refers to the ability to mass-produce custom parts, enabling mass timber construction to both achieve the efficiency savings from prefabricated construction techniques along with the unique building characteristics of materials made-to-order.

Ecosystem Coordination

To successfully achieve mass customization, the mass timber ecosystem has to achieve high levels of coordination between architecture, engineering, construction, and material production. Close partnerships among key stakeholders that are used to working with each other at arm’s length are a critical success factor for mass timber industries.

Illustrative view of the mass timber ecosystem, with core partners needing close coordination highlighted

Coordinating the ecosystem is a role that government and research institutions can play. In Ontario, the Mass Timber Institute has taken a lead in coordinating the development of Ontario’s mass timber industry, however there remains a large place for public leadership, policy, and support. Governments can encourage coordination in the ecosystem by holding mass timber design competitions for public construction projects, or by creating incentives for new construction to use mass timber. There is also still much work to be done in bringing mass timber education and policy down to the municipal level. Public policy plays a huge role at the municipal level in determining building codes.

New Building Codes

Building codes are a critical enabler for mass timber production, and recent developments in North American building codes are a major trend driving mass timber growth. As we saw in the Finland case, permitting taller mass timber construction led to a sharp increase in new timber construction. In 2015, the US and Canada allowed for 6-storey mass timber construction, and mass timber has grown over 40% annually each year since. Canada’s new NBCC (2020) and the US’ IBC (2021) will allow for 12- and 18-storey mass timber construction, respectively. The caveat is that these codes allow for encapsulated mass timber, meaning that (depending on other building properties like height and size), only a limited portion of the timber structure can be exposed. So while developers hoping to gain the benefits of exposed timber may still need extra building approvals, this still does much to pave the way for more new mass timber construction. And while the national building codes will change, each municipality must also adopt the new codes independently and so a large policy effort remains.

Mass Timber’s Sweet Spot

It’s important to note a key insight in the mass timber industry, and a big reason why Finland’s code change led to so many more mass timber developments. Mass timber construction has a sweet spot somewhere around 4 to 18 storeys where it has the potential to be the most cost-effective construction material. Build shorter than this and a lightwood-frame performs better, build taller and concrete/steel are far cheaper. But in this sweet spot, mass timber has the potential to outperform all other options. This along with the new building codes will allow for mass timber to capitalize on construction industry trends leading towards more multi-storey multifamily construction, which usually falls in this 4 to 18 storey range, growing mass timber’s market share.

Barriers to Adoption

So we’ve discussed many of the tailwinds behind mass timber’s recent growth. However, if it’s so great, why is it still a niche material and what would it take to make mass timber mainstream?

One of the key barriers to more widespread adoption of mass timber is what we at Mantle314 call the “chicken-and-egg problem”; basically that demand and supply are mutually constrained by the other. Developers will not build in mass timber if they cannot ensure a suitable supply, and mass timber supply chains across North America are still patchwork, with few suppliers covering large geographic regions (Ontario currently only has 1 mass timber supplier, Element5’s St Thomas plant, which as of August 2020 has yet to start production; most Ontario mass timber projects import from Quebec, BC, or even Europe). However, supply economics for mass timber mean that factory profitability is highly sensitive to factory utilization, which incentivizes investments in factories that can already secure demand for their mass timber product; this disincentivizes investments in factories with capacity larger than current local demand, or capacity to grow production. This is the chicken-and-egg problem: which can come first, the demand or the supply?

This barrier makes a good case for government intervention in the market. Supply-side, governments can invest in mass timber production alongside private companies, as Ontario’s Forestry Growth Fund supported Element5 with a $5m investment in the St Thomas, Ontario factory. Demand-side, governments can build demand by building in mass timber for public construction projects and by implementing policies like BC’s Wood First Initiative, which co-invests in mass timber construction, research, and market development to advance BC’s forestry industry.

In our recent blog post, we outlined 4 major barriers to adoption: supply chain gaps, distribution challenges, building code compliance, and cost. These challenges are also borne out in data collected by Syed Taha in his 2020 paper published by University of Toronto’s Mass Timber Institute, where he interviewed dozens of current industry stakeholders. Among the top barriers identified are “supply and demand gaps”, “lack of local production”, “building code compliance”, and “higher cost of mass timber products than concrete/steel”.

Taha’s research also highlights several other critical barriers. There is a lack of skilled tradespeople and subcontractors needed to assemble a mass timber building: the carpenters, electricians, plumbers, and so on which need to learn new methods of working. There is also an industry inertia towards building with the same traditional materials, and not for no reason: when a mistake could mean a catastrophic, life-ending disaster, even very small risks can be too much to take. Decades of history in education and practice with traditional materials take time and proactive efforts to change.

Finally, there is a challenge relevant to mass timber’s purported cost savings, much of which stem from a faster construction with fewer crew. In practice, building a mid-rise (6+ storey) building in this “sweet spot” in mass timber today in Toronto actually carries a 10% price premium, according to mass timber expert Mark Gaglioni of Ellis Don, a Canadian construction company which is building several of Canada’s mass timber buildings. A driving reason for this is that while mass timber allows for the wooden superstructure of a building to be built rapidly, other building trades (mechanical, electrical, and plumbing) are not organized for that rate of work and still usually take the same amount of time as a traditional build unless additional resources are added into these activities. So although it is possible to achieve some superstructure schedule savings through careful planning, the project’s end date may still remain relatively unchanged. Adding the additional complexity, difficulties finding skilled installers, additional code approvals, a resistance to change within a busy trade marketplace, and higher insurance premiums, you can reach the ~10% price premium that they have found is currently applicable for mass timber in Toronto.

These barriers are not insurmountable. Trends are leading towards more mass timber demand and the past 5 years have seen explosive growth in mass timber production; eventually, there will be enough chickens and eggs that it doesn’t matter which came first. Many industry proponents believe that as the industry matures, the price premium will drop and we will achieve the promised cost savings. Public policy can help us surmount these barriers even quicker: easing approval processes, coordinating supply chain developments, investing in supply and demand, and fostering collaboration and research across the mass timber ecosystem will all lead to more widespread adoption of mass timber. Here at Mantle314, we believe it’s no longer if these developments in mass timber will happen, the only question is when.

Thank you to Suhayl Chettih, MBA Candidate, Harvard Business School, for his contribution to this research and article.

References

1 Price proxy of $700 / m3 (Brandt et al)| 1,500 m2 as average building size using 90m2 is average unit size at 15 units median per building & 25% shared/service space | 413 m3 timber needed for a 1,500 m2 building (ratio from Candlewood case) | 303 CO2 avoided per m2 built (Mantle314 calculation) | 678 kg CO2 sequestered per m3 mass timber

Contact us to help manage your climate risk

Mantle works with real estate owners/developers, built environment designers, and policymakers interested in climate-smart construction including the use of mass timber and other low carbon construction materials. We implement green building best practices including Zero Carbon Building standards, LEED, and embodied carbon analysis and reduction strategies.

Contact us today to give your organization a competitive advantage on climate change.